what is a covered tax lot

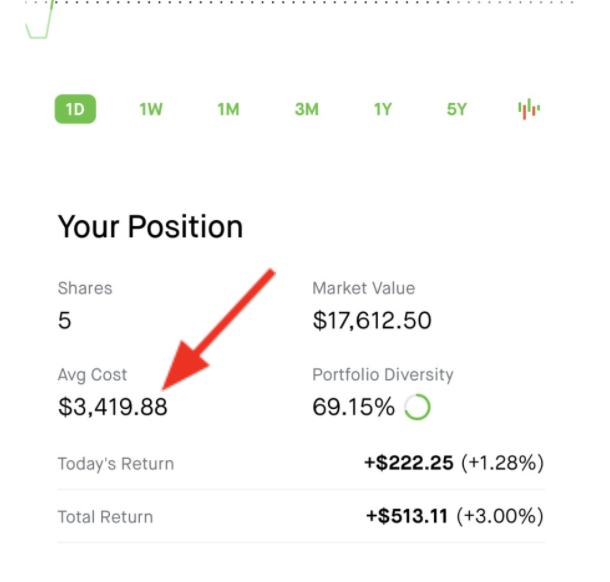

How To Use Tax Lots To To Pay Less Tax Each time you. Every time you buy shares you create a new tax lot that records the number of shares the transaction date and the cost basis.

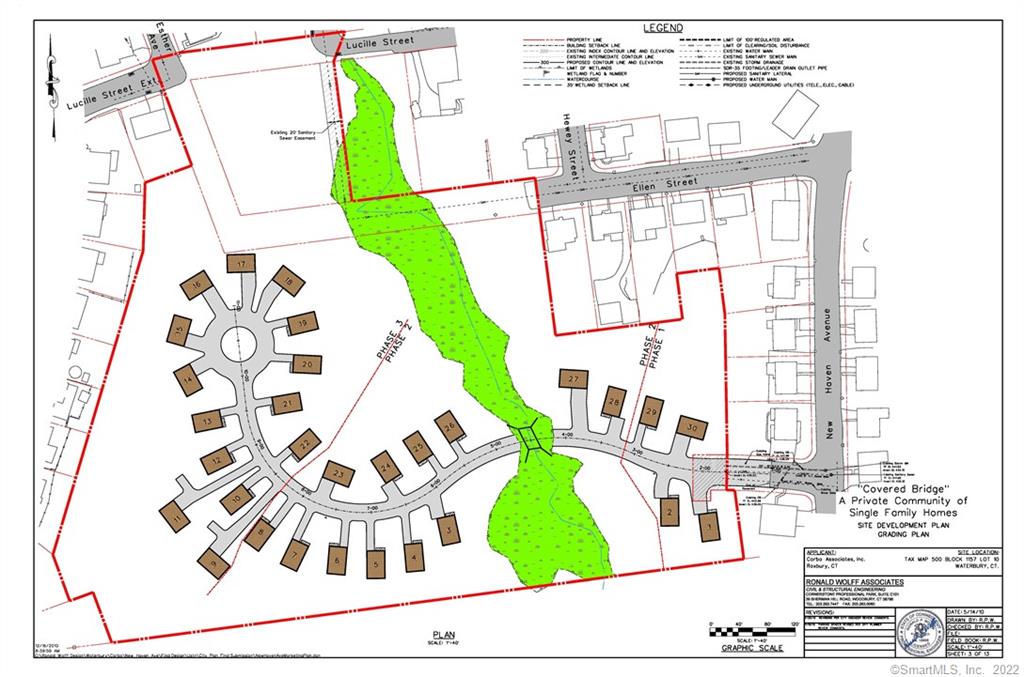

Tax Map 34 3 A Covered Bridge Rd Kents Store Va For Sale Mls 630455 Weichert

Lot G is mostly an uncovered lot with a small amount of covered spaces available on a first come first served basis.

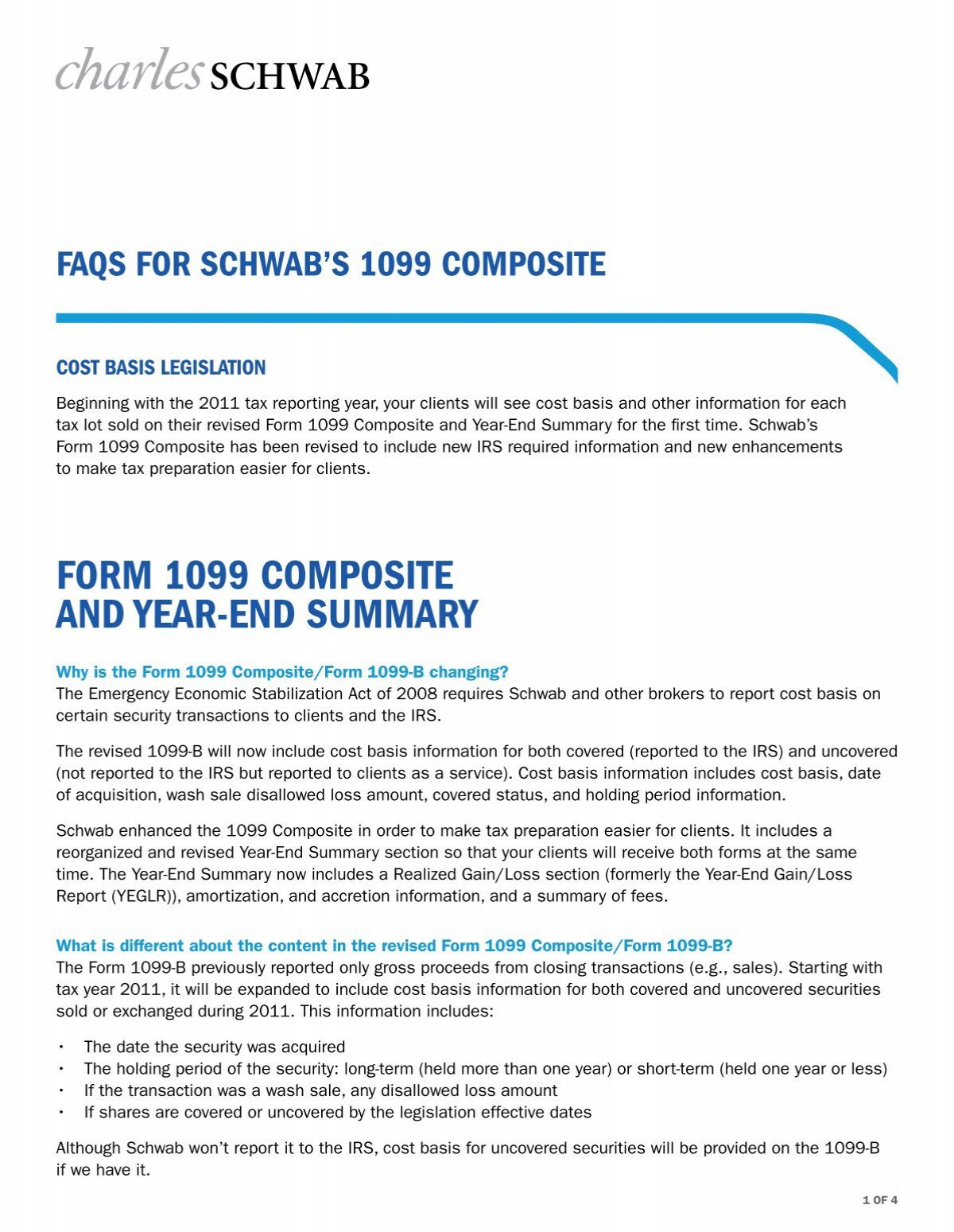

. What are covered tax lots. Covered shares are shares. For covered lots and a new summary of adjustments to income and OID noncovered lots described later.

B any income Tax described in clause ii or iii of the definition of Tax. UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS. This is a tax form that details the sales of stocks bonds and other capital investments.

This is the standard treatment that will apply to catch. New tax rules over the years have been aimed at alleviating the. When an investor buys a security the tax.

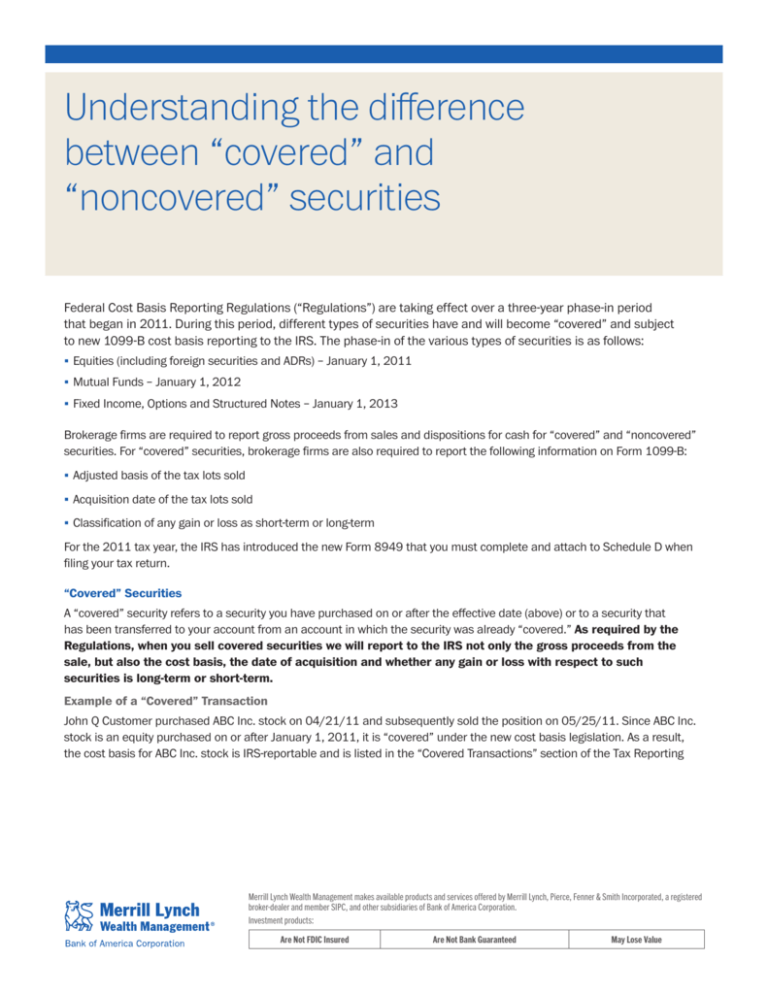

Fortunately tax straddle rules do not apply to qualified covered calls A qualified covered call is a covered call with more than 30 days to expiration at the time it is written and a strike price. 1 A covered security is defined as. Shares of corporate stock acquired on or after January 1 2011.

We accept Visa MasterCard American Express cards and. Each time you purchase a security the new position is a distinct and separate tax lot even if you already. Fortunately tax straddle rules do not apply to qualified covered calls A qualified covered call is a covered call with more than 30 days to expiration at the time it is written and a.

The 1099-B I received from my brokerage includes several transactions labeled as UNDETERMINED. Income Menu Capital GainLoss Sch D Select New and enter the. Any tax recorded in the financial accounts of a constituent entity that is levied on its income or profits.

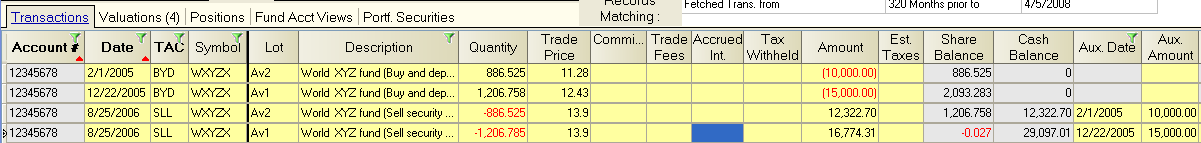

Any transaction that occurs on or after this effective year is a covered security and is reported on Form 1099-B. A covered security is an investment for which a broker is required to report the assets cost basis to the Internal Revenue Service IRS and to the owner. For covered shares were required to report cost basis to both you and the IRS.

Shares of stock in mutual funds and stock acquired in connection. You can specifically identify which tax lots to include in. For tax-reporting purposes the difference between covered and noncovered shares is this.

Any stock in a corporation. Tax lot accounting is a method of accounting for the purchase and sale of securities that aims to minimize capital gains taxes. UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS.

An investment is considered covered if it is. If they owned the shares for less than a year their profits will be taxed at the short-term rate the personal income tax rate. A covered tax is defined as.

Form 8949 reports three subgroupings covering six codes. To enter the sale of a covered or noncovered security from the Main Menu of the Tax Return Form 1040 select. What is a non covered tax lot.

/cloudfront-us-east-1.images.arcpublishing.com/gray/IKBUYXKUKJAGTCRVLN5LJ4OXWY.png)

Here Are Some Key Takeaways From This Year S Legislative Session

Rsu Taxes Explained 4 Tax Strategies For 2022

Tax Map 34 3 A Covered Bridge Rd Kents Store Va 23084 Mls 630455 Listing Information Homes For Sale And Rent

5 Things You Should Know About Capital Gains Tax Turbotax Tax Tips Videos

Covered Buildings Under D C Benchmarking Pdf Condominium Washington

How Are Futures And Options Taxed

Form 1099 Composite And Year End Summary Charles Schwab

:max_bytes(150000):strip_icc()/Cover-call-ADD-V1-551e4fa02e3a4af2bb0768956e8c0cc7.jpg)

Covered Calls How They Work And How To Use Them In Investing

0 Ellen Street Waterbury Ct 06701 Compass

Covered Vs Noncovered Stock Transactions

How Do You Report Undetermined Term Transactions For Noncovered Tax Lots On Your Taxes R Tax

Secured Property Taxes Treasurer Tax Collector

925 West 2nd Street Arlington Or 97812 Compass

Tax Commission Expense 2015 Form Fill Out Sign Online Dochub